Loan option forms are for both Purchase and Refinance

2024 Fannie/Freddie and FHA loan limits are sourced to offer

Prospect’s rates that are based on a subject property’s zip code

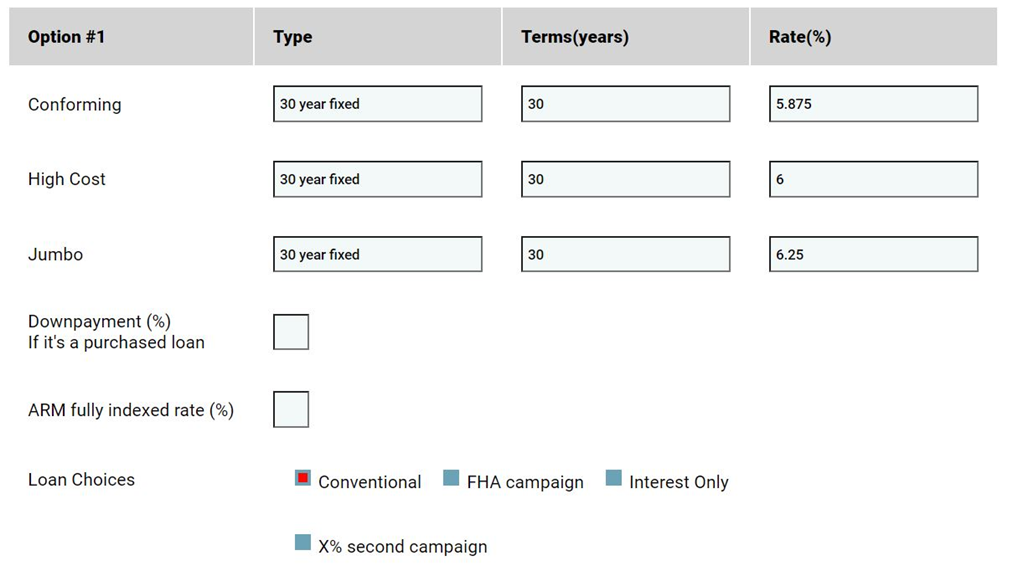

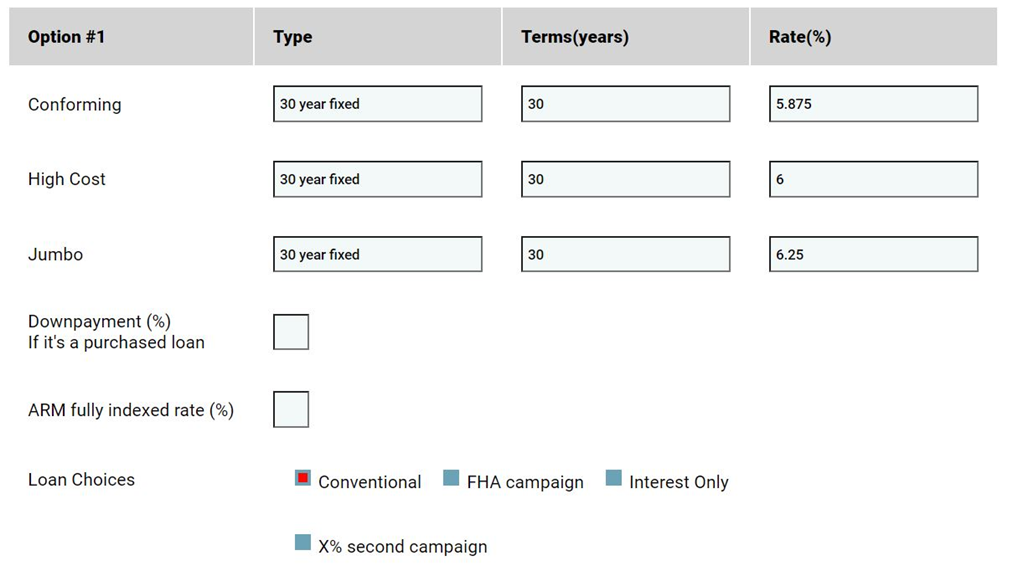

Filling out the form

Type: You can offer: Conventional, Bank Statement (Business or personal), DSCR, Interest only, Stated income

Term: Any term

Down-payment: Any down payment %

ARM: Please input the index + margin rate

Loan Choices: are for both refinance and purchase

Conventional for Conventional, Bank Statement, DSCR, and stated Income loan options

FHA loans. An Upfront mortgage insurance premium of 1.75% is calculated and included in FHA purchase and refinance loan amounts

Interest only-please use this button for all your interest only loan options- including purchase, refinance, conventional and non-conventional loans

When sourcing rates, please make assumptions on a prospect’s FICO, property LTV, and purchase downpayment

Examples

Conforming: 70% LTV rates, 720 FICO, cash out refinance, owner-occupied, $1,000,000 value, and $700,000 as the loan.

High Balance: 70% LTV rates, 720 FICO, cash out refinance, owner-occupied, $1,400,000 value, and $980,000 loan

Jumbo: 70% LTV rates, 720 FICO, cash out refinance, owner-occupied, $2,000,000 value, and $1,400,000 loan.

Example of a refinance loan option

Example of a purchase Bank Statement loan option

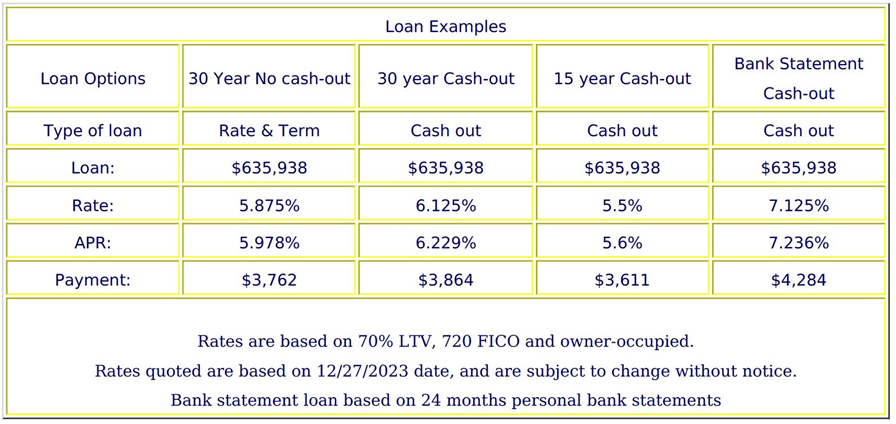

Cash-out examples in a refinance campaign